Connect with a Lima One expert today!

If you’d like to know more about this topic or see how it applies to your project, let’s talk.

MultifamilyScaling Your Portfolio

Is it Time to Capitalize on a Multifamily Real Estate Investment in DC?

The Washington, D.C. real estate market has been growing at a much healthier pace compared to most peer metros. Median home prices and rental prices have increased steadily since the pandemic real estate boom.

- As of August 2021, median home prices in Washington D.C. increased to $585,000 – a 6.4% increase YOY.

- Housing inventory in D.C. is currently at 1.3 months’ supply, which is a bit lower than the 5-year average of 1.8 months.

- The average time for a house on the market in Washington D.C. increased to 20 days, which is a slight increase from the height of the pandemic boom but still 30% below the 5-year average of 28 days.

- The average monthly rent of current leases across all rent classes in Washington, D.C. increased from $1,807 to $1,890 – a reasonable 5% YOY increase.

Most of D.C.’s real estate market statistics are close to the 5-year average. Because of these stable market conditions, investors need not fear overvalued properties in our nation’s capital.

Washington, D.C. is experiencing one trend a lot of other markets are not – fix and flip profits are good. Investors are seeing ROI percentages that are higher than the national average, and the overall profit on a fix and flip property should be attractive to an investor. New construction in the nation’s capital has also picked up considerably in recent months. Permits for SFR home construction have increased 11% YOY while permits for multifamily housing construction have increased 34%. Overall, construction permits have increased by 21% YOY.

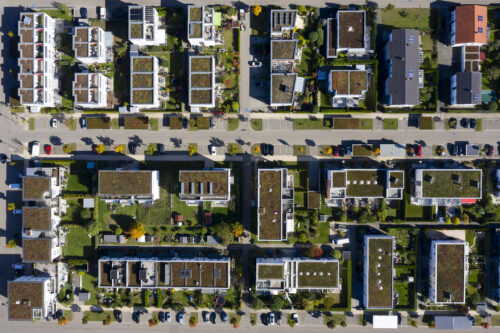

Washington D.C.’s multifamily market is especially booming. Through May 2021, multifamily transactions in D.C. totaled $1.6 billion. At that time, 42,817 multifamily units were under construction in the market – accounting for about 8% of existing inventory. An additional 59,500 units were in the planning and permitting stages.

Because of this, the DC metro is currently 2nd in the nation in overall multifamily development activity. It’s hard for investors to ignore the benefits of investing in multifamily properties in D.C. when the market is flourishing there.

Investing in Washington D.C.’s Rental Market

Washington, D.C., which borders both Virginia and Maryland, offers plenty of opportunity for investors regardless of their investment strategy. The D.C./Northern Virginia area has seen a slight increase in available inventory in recent months, but the market is still extraordinarily tight. Given the lack of inventory, it hasn’t been uncommon to see most D.C. listings sell within a week or two - and for well over the asking price. In June 2021, new listings were up 36% from 2020, but the total supply of homes for sale was still down 9%.

The market still hasn't settled back down to pre-pandemic levels, which makes it harder for homebuyers with more limited budgets who can't afford to offer above asking price or pay in cash. Because of rising home prices, younger people are opting to rent rather than buy, which is good news for Washington DC real estate investors.

D.C.’s apartment rental market was upended by the COVID-19 pandemic as vacancies soared and rental rates plummeted. Now, those renters have returned to the D.C. area, and the city’s rental activity stats show how popular the area is. Washington D.C.’s rental market currently ranks fifth for increase in overall rental activity in the first half of 2021 thanks to a spike of 41% over the first half of 2020. Most of those renters are Gen Z adults and high-earning Millennials. Rental applications from Gen Z adults increased 92% YOY.

Monthly apartment rent prices in D.C. showed YOY monthly declines during most of the pandemic but began to stabilize in Spring 2021. The average cost of rent in the area is still lower than it was a year ago, which has helped to revive rental activity.

Rental Vacancies Are Down, But Monthly Rents Are Up

When the pandemic began, renters in downtown urban apartments led to a mass exodus into the suburbs. The theory behind the increase of renters leaving downtown areas is that with the ability to work from home, there was no longer a need to pay the high cost of living to reside in these areas.

In large cities across the country, the pandemic caused an explosion in rental vacancies. Now that people are moving back to city centers, rental vacancies are down, and rental prices are going back up. For example, occupancy in D.C. has increased slightly from 94.2% to 94.6% YOY, which indicates a strong rental market. Apartment List also shows that the average monthly rent in D.C. fell about 15% during the pandemic. Since January, it has risen 11%.

This is all good news for real estate investors. Despite increases in rent prices, individuals and families alike are returning to the city once again and signing apartment leases, which creates income for multifamily property investors who own those buildings.

Washington D.C. Is Growing & In Need of Housing

Washington, D.C. is recovering well post-COVID. The city’s real estate experienced some ups and downs during the pandemic, but there are many factors showing a road to recovery.

The D.C. area continues to benefit from a stronger job market compared to other large cities in the U.S. Yardi Matrix data shows the strongest growth among apartment applications in the first half of 2021 were among those earning between $50,000 and $75,000, up 62% from the same period a year ago. August data from the U.S. Bureau of Labor Statistics shows that D.C.’s unemployment rate has dropped to 6.5%. D.C.’s unemployment rate has dropped a total of 1.2% since March 2021. Additionally, data from the U.S. Bureau of Labor Statistics shows that Maryland’s unemployment rate fell to 5.9% in August while Virginia’s fell to 4%.

The District of Columbia is surrounded by some of the largest and most popular cities in Maryland and Northern Virginia, which has helped spur growth in D.C. Maryland’s Department of Labor announced in September that the state had gained 11,900 jobs in August, for a total of 65,900 jobs in 2021. Northern Virginia has also seen positive job growth. From July 2020 to July 2021, the region has seen an increase of 70,800 jobs – making the area responsible for nearly 50% of the 143,800 jobs gained statewide during that time frame.

In the past year, D.C. has gained or regained 24,800 jobs, for an annual job growth rate of 3.4%. And those jobs are attracting people to the region. Washington D.C., Northern Virginia, and Maryland are home to some of the largest companies in the country. The area’s major industries include aerospace and defense, banking, technology, and transportation. The region’s largest employers are the federal government, Lockheed Martin, Danaher, General Dynamics, Northrop Grumman, and Capital One.

Washington D.C. is well-positioned to take advantage of this economic growth. The city is ranked as the 3rd best city for young professionals, the 5th best city to live in, and the 8th best market for real estate. The D.C. metro area is projected to add 490,000 residents between 2021 and 2030 – an increase of 5.38 million residents in 2021 to 5.87 million in 2030.

What Does Washington D.C.’s Multifamily Market Mean for Investors?

Washington D.C.’s rental market is in an interesting place in that multiple sectors are performing well. But right now, the city’s multifamily sector is leading the pack in real estate investment opportunities. This is great news for investors who have a multifamily investment strategy and are looking for a thriving multifamily market. D.C.’s multifamily market stats paint a great picture of what investors can expect.

Washington, D.C. presents plenty of opportunity for real estate investors. The three-year rental trend shows growth across all rental classes. Over the past three years, rent in the D.C. area has grown 7.4% - bringing monthly rents from $1,760 to $1,890.

Despite low inventory and increasing home prices, Washington, D.C. investors with strong real estate investment strategies can still profit. It’s now more important than ever to have an experienced lender capable of helping you:

- Secure a loan with the best price and maximum leverage for your next rental investment

- Close properties quickly and certainly

- Run your construction and rehab projects smoothly

If you’re interested in multifamily financing in Washington, D.C., call us to learn more. When it comes to funding multifamily loans, we’re the expert you’re looking for. Lima One’s multifamily loan program is second-to-none because we’re able to offer services that other lenders can’t.

From the initial application all the way to loan payoff, you will work with our in-house teams. Our team of experienced professionals will help guide you through purchasing or refinancing multifamily properties in need of value-add rehab or those that are currently turnkey ready.

Get started today and scale your rental property portfolio with Lima One, the nation’s premier lender for real estate investors.

Washington DC Multifamily Rental Market Stats

- The average sales price per unit is $255,758 and ranks 15th of 98 markets in price.

- Nearly 26,000 new multifamily units are projected to be completed by June 2022.

- The average rental price of multifamily units is $1,890 (September 2021) – a 5% increase YOY.

- Currently, D.C. ranks 2nd out of 98 nationwide markets in multifamily development activity.

Nationally, Washington DC is ranked:

- 8th for overall real estate prospects

- 19th for homebuilding prospects

- 13th for investor demand

- 24th for development opportunities

Recently Funded Deals

Subscribe for More Insights

Get the latest industry news & Lima One updates.