Connect with a Lima One expert today!

If you’d like to know more about this topic or see how it applies to your project, let’s talk.

Unveiling the Synergy of White Label Table Funding and Loan Origination

What is a Table-Funded Loan?

White label table funding is the use of one lender’s capital to fund another lender’s loan at closing. It’s a popular option for smaller private lenders who fund real estate investment property.

In a table-funded loan, the lender named in the loan document is different than the actual lender providing the money to fund the loan. In most transactions, the loan originator underwrites and processes the loan but doesn’t fund it. At the closing table, the funding entity will wire funds into escrow for the borrower.

How the Table Funding Process Works

Essentially, table lending works like this:

- The borrower, Joe, applies for a fix and flip loan through Lender A.

- Then, Lender A goes to Lender B and says, “I have a quality loan. I need capital to fund it.”

- Lender A prepares the loan paperwork for Joe. Lender A then assigns the loan to Lender B, who provided the capital.

- On the surface, Lender A is fulfilling the due diligence as the lender, but Lender B is providing the capital for Joe’s loan.

This type of lending is called table funding because the funds for the loan are provided at the closing table while the documents are being signed.

The Benefits of White Label Loans

White label financing allows private lenders to offer the benefits of personalized service while accessing capital from a large lender. White label real estate services enable investors to choose a lender with their preferred underwriting and closing processes while still having security about loans closing.

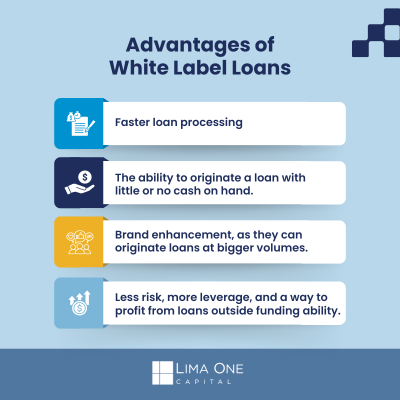

Key Advantages for Private Lenders

- Faster loan processing

- The ability to originate a loan with little or no cash on hand

- Brand enhancement, as they can originate loans at bigger volumes

- Less risk, more leverage, and a way to profit from loans outside their funding ability

Leveraging White Label Loans for Real Estate Investing

Real estate investors crave reliable options for funding. Who wants to go through the process of comparing lender quotes only to get held up in the underwriting process or see the deal fall through at the closing table? Instead, investors want lenders who can ensure the loan closes—and a white-label table-funding solution can help.

Subscribe for More Insights

Get the latest industry news & Lima One updates.