The Premier Private Lender for New York Real Estate Investors

Lima One Capital is the nation’s premier lender for real estate investors in New York and beyond. Our private real estate loans are ideal for investments in New York City’s five boroughs, as well as upstate New York locations like Albany, Buffalo, or Rochester.

A full suite of residential private real estate loans, designed to help NY investors purchase or refinance:

- rental portfolios

- rental properties

- new construction builds

- fix and flip projects

- multifamily bridge loans

Unlike traditional hard money lenders, you’ll find the best combination of underwriting speed, closing certainty, and service through the life of your loan with Lima One Capital, and you’ll also get competitive interest rates. As your go-to private lenders in New York, we understand that time is of the essence when it comes to real estate investments. That’s why we offer fast and flexible loan products that are tailored to meet your needs.

Contact us today to start your next New York real estate private investment with financing from Lima One.

A Better Choice Than New York Hard Money Lenders

For dependable real estate investment loans in New York, choose Lima One Capital. You don’t have to worry about extended timelines, missing closing dates, or last-minute rate or fee changes, like you do with other hard money lenders. Instead, Lima One offers the best combination of customer service, loan products, reliability, and speed.

Lima One Capital has closed more than 10,000 loans worth more than $4 Billion over the last 10 years. This proven track record shows New York real estate investors that Lima One is the right choice for your next fix and flip loan, rental portfolio loan, multifamily bridge loan, or new construction loan.

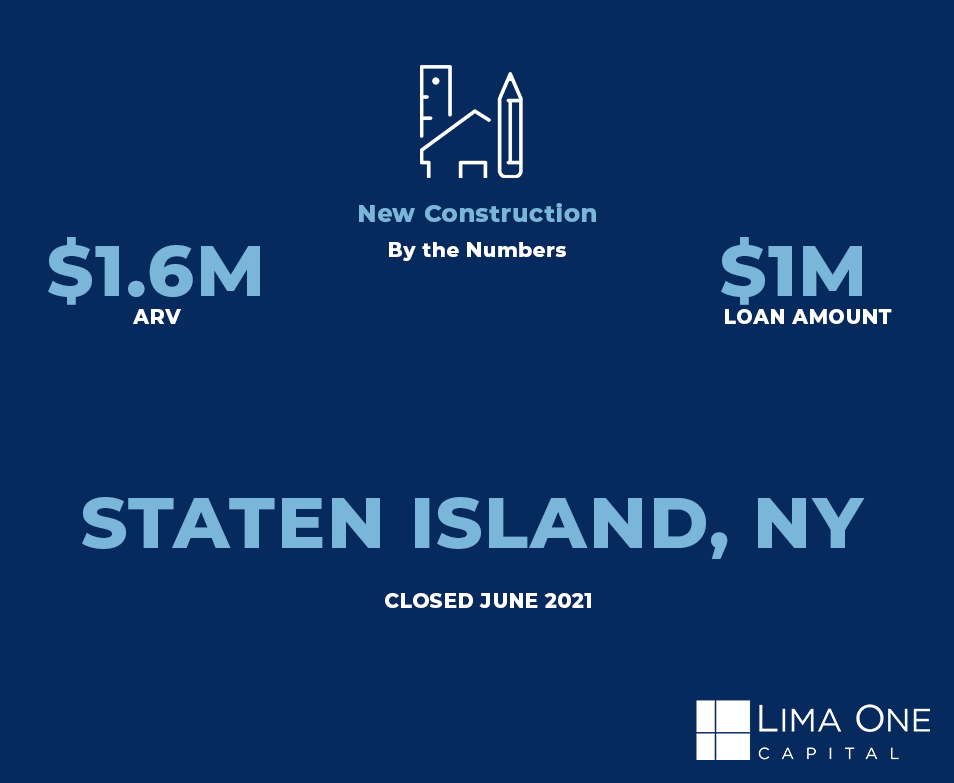

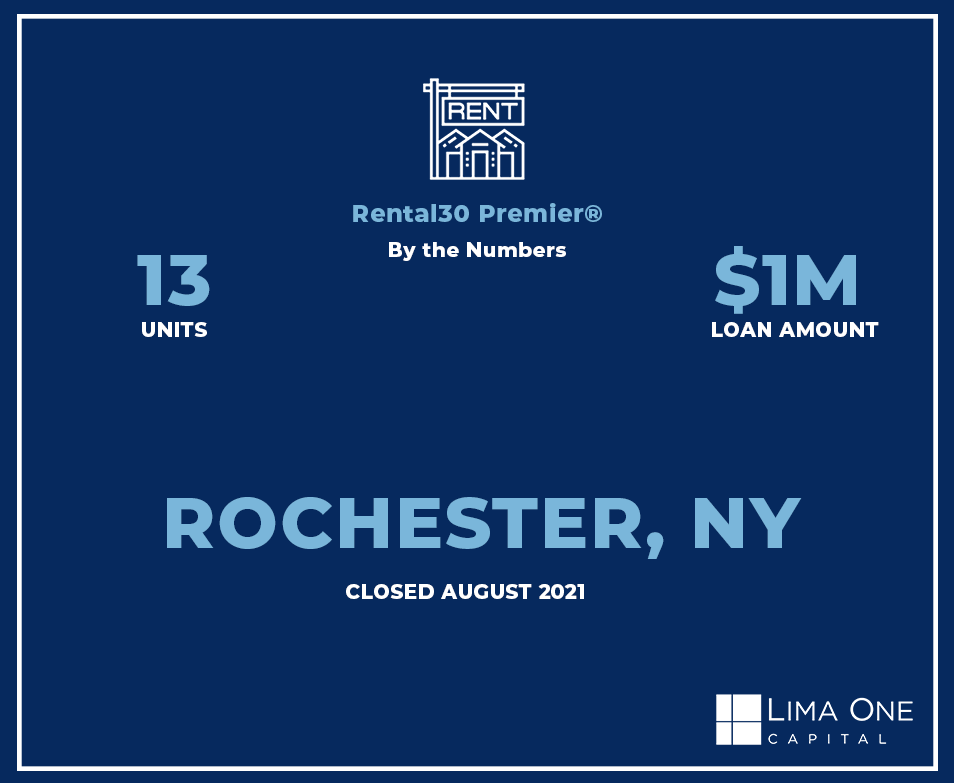

New York Real Estate Investment Case Studies

Click the images or links below to learn more.

Lima One Capital provides comprehensive New Construction loans that cater to the specific needs of builders and developers in New York. Our financing solutions cover a range of projects such as spec houses, model homes, subdivisions, infill developments, and teardown projects.

Whether you’re a seasoned real estate investor in New York or just getting started, Lima One Capital’s Rental30 Premier program can help you achieve your investment goals. View more of our real estate investment case studies.